17 July 2023

Kuala Lumpur

Malaysia

Overview

“Often the case, Top Management come from different backgrounds, bringing with them lots of expertise (Marketing, Finance, Operations, Strategy) and they often fail to understand the impact of their decision on the financial outcome of the overall business.”

Add value to your organization by leveraging financial management concepts and techniques to make critical strategic and economic decisions with this Masterclass! Just ask the impressive list of companies that have already attended, including Intel, Hitachi, Petronas, Nissan, Changi Airport, Chevron Phillips, and many more!

Why you should attend

If you’re an experienced manager who wants to know how to use financial concepts and techniques to make better management decisions, then this course is for you. Regardless of the functional area you work in, this seminar will help you be more confident about your ability to create value for your organisation.

You will be able understand the most important concepts in financial management and you will learn how senior executives make use of them to make critical strategic and economic decisions. You will get practical experience using your new skills by applying them to real world examples. This seminar will assist you to become recognised as a knowledgeable and skillful strategic thinker in your organisation and you will be able to engage with other senior executives in a more confident and meaningful way.

By the end of this course, you will learn to:

- Develop a clear view of how your operational decisions affect financial outcomes in your business

- Make better use of financial information to assist you in making better quality management decisions

- Have better understanding of the factors that drive profitability and lead to financial success

- Understand the critical role of cash flow and know how to manage and forecast cash flow

- Understand what financial value is, how to create it and how to measure it

- Understanding the difference between value and profit in order to create economic value in your role

- Maximising capital and managing the balance between financial efficiency and stakeholder expectations

This is an opportunity you won't want to miss - enhance your financial knowledge and make better strategic financial decisions for your company's growth! Sign up for Dr. James Hay's Strategic Finance for Decision Makers Masterclass today!

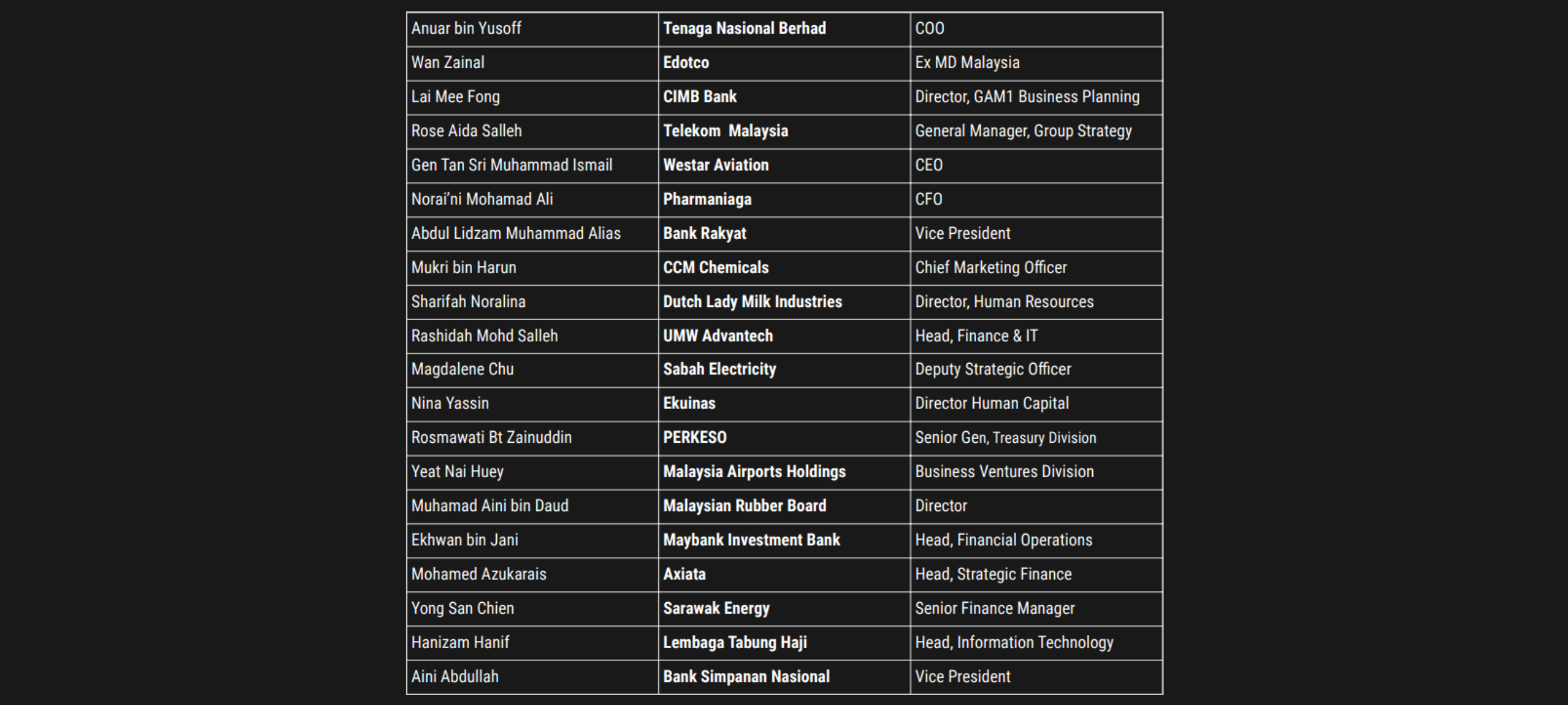

Previous notable attendees:

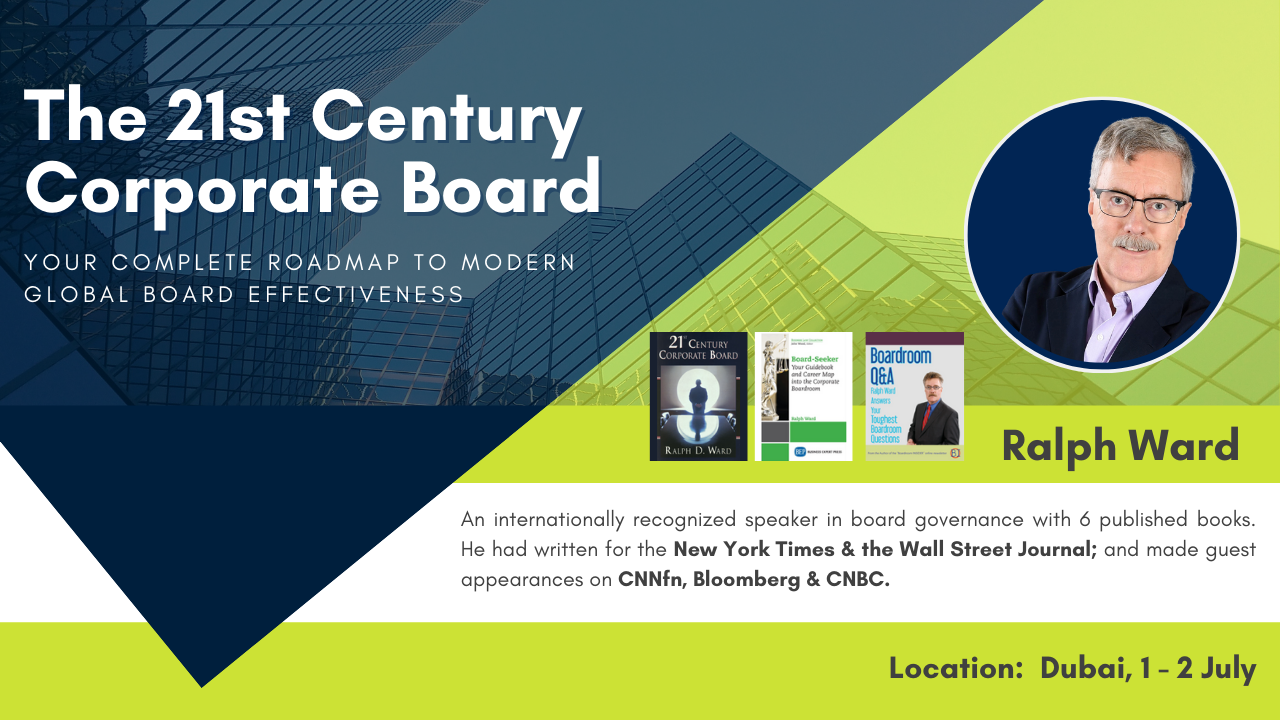

COURSE FACILITATOR

Dr James Hay

PhD, BLitt (Hons)(Melbourne), MBA (Cornell), BSc (Monash)

Achievements

James Hay is a highly experienced and renowned finance trainer with over thirty years of experience. He has worked in risk management, corporate finance, and capital budgeting for some of Australia's largest companies.

James has an impressive track record of working with top-tier clients such as Westpac, Woodside, Shell, ExxonMobil, ANZ, General Motors, CSL, Petronas, Petroleum Brunei, and OQ. He has a strong educational background, holding certificates from The University of Melbourne, Cornell University and Monash University.

He is a sought-after trainer who can provide valuable financial education and investment appraisal services to corporate and institutional clients. His expertise and experience make him the ideal trainer for any business manager looking to enhance their financial knowledge and decision-making abilities.

Has Worked With

Trainer Videos

Agenda

Strategic Finance for Decision Makers

Session 1: The Role of Finance in the Organisation

- The Corporate Value Chain

- Financial management responsibilities

- Accounting, Finance, and the Corporate Treasury

- Accounting statement refresher

- Balance Sheet, Income Statement, Cash Flow Statement

Session 2: Financial Ratios and Value Creation Strategies

- Invested capital and Net Operating Income After tax (NOPAT)

- Dupont Analysis

- Return on Equity vs Return on Invested Capital – how debt is used to “gear up” returns

- Profit Margin versus Asset Turnover strategies

- Operational strategy versus financial strategies

Session 3: The Cost of Capital (WACC)

- Risk, return, and value

- Credit ratings and the cost of debt

- Volatility, Beta and estimating the cost of equity

- Capital Asset Pricing Model

- The Weighted Average Cost of Capital (WACC)

Session 4: Discounted Cash Flow and Investment Decision Making

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Identifying incremental cash flows

- Using Net Present Value (NPV) to evaluate project alternatives

- Developing a business case for investment projects

Session 5: Creating and Measuring Economic Value

- How finance provides a method of measuring economic gain or loss

- Accounting Values, Market Values and Economic Value

- Why is value different than profit?

- How you can create economic value

- Measuring value created through Economic Value Added (EVA)

- The relationship between EVA and Return on Invested Capital

Session 6: Free Cash Flow and Business Valuation

- Price verses Value

- Cash versus Profit How you can be “profitable” yet go out of business

- Estimating free cash flow

- Terminal Values and growth assumptions. What is a sustainable growth rate?

- Using free cash flow to value a business

Session 7: Managing Working Capital

- Working capital measures and metrics

- Estimating receivables days, payables days and inventory days

- The Operating cycle and the cash cycle

- The trade-offs between time, and prices paid and received

- How working capital may be a source as well as a use of capital

Session 8: Debt and Risk Management Strategies

- Determining optimal debt levels

- Identifying financial exposures

- Foreign exchange, interest rate, and commodity price exposure

- Exposure management tools: Forwards, futures, options, “exotic” tools

- Exposure management (hedging) versus speculation

- Should all exposures be managed?

TESTIMONIALS

Check out the testimonials from our events